SAFE

SAFE

SAFE

In the previous post of QuotaWiki series, we learned what convertible note is. It was a response to founders' and investors’ needs to make the funding process quicker and simpler. Still, convertible notes had some unsolved problems, so SAFE came up to deal with them.

🙋What is a SAFE?

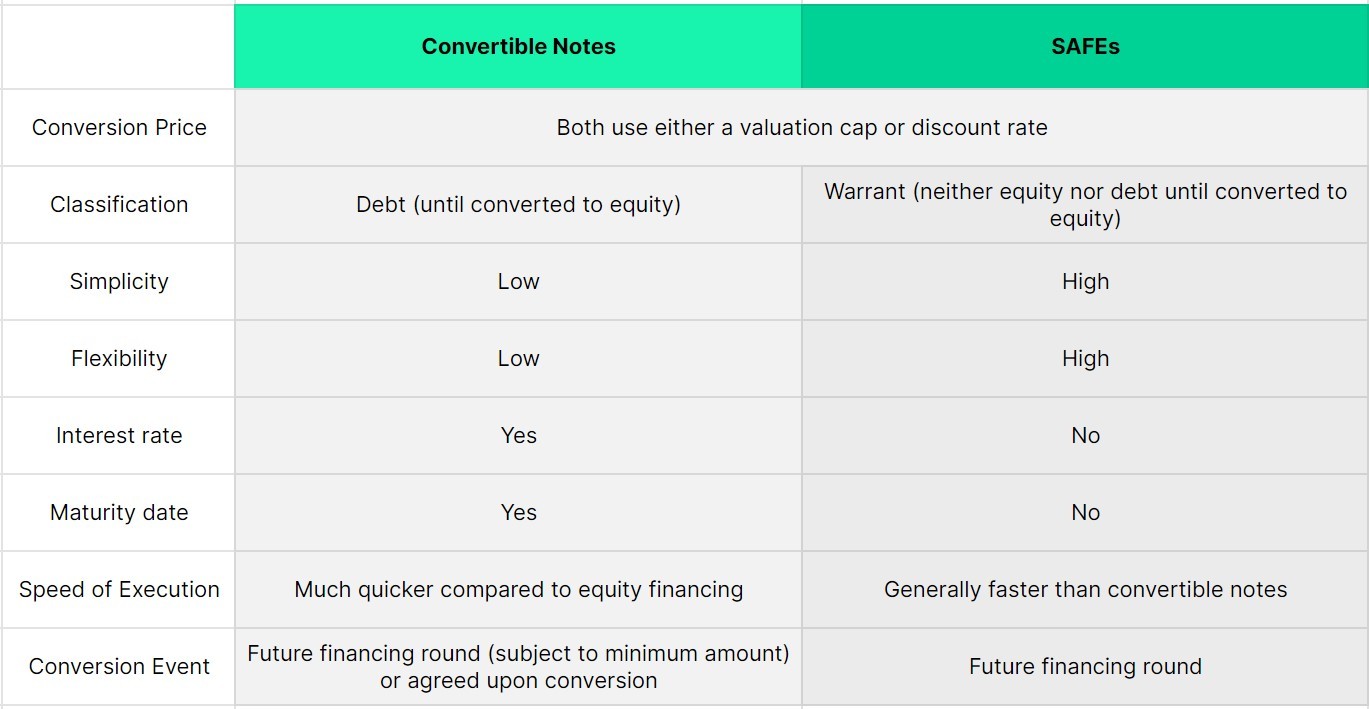

SAFE stands for “Simple Agreement for Future Equity.” Y Combinator, one of the most well-known accelerators, introduced this concept in 2013. Since then, SAFE along with YC’s standard documentation have become a widely used fundraising method for early-stage startups. Although convertible note remarkably reduced the financing complexity by postponing the valuation process until next funding round, it is still classified as a debt. Thus, it is bound to debt-related fixed terms like interest rate and maturity date which make the conversion or possible extension complicated. SAFE got over such drawbacks by taking a unique position of something like a warrant. What investors buy is neither a stock nor a debt, but the right to buy stock in the future equity round. To sum up, SAFE works just like convertible note, but with fewer complications.

🙋How does SAFE work?

SAFE investors get the right to convert their SAFE into stocks at the company’s next equity financing round or liquidation event. The conversion price is determined by either a valuation cap or a discount rate. Valuation cap is the maximum price a SAFE convert at, and discount rate is the discount of priced round valuation for SAFE investors when they convert. SAFE holders get the biggest advantage with lower valuation cap and higher discount rate. Like convertible note, SAFE can have either valuation cap or discount rate only, or both of them so SAFE holders can choose more favorable option. In addition to this, SAFE can come with “Most Favored Nation” clause, which applies the most favorable terms offered to new investors in the next priced equity round.

🤔Necessity of SAFE Simulation

Dilution is probably the major concern for both founders and investors when issuing SAFE. Simulation to estimate such dilution is important because it is affected by the valuation of next priced round and new investors also care a lot about it. Simulation is as complicated as managing the SAFE itself, but QuotaBook can help you with both problems. Let’s schedule a demo to discuss your needs and show you how we solve them.

References

https://learn.angellist.com/articles/safe-note

https://www.ycombinator.com/blog/announcing-the-safe-a-replacement-for-convertible-notes/

https://learn.angellist.com/articles/convertible-note

※ Legal disclaimer

Make Equity Complete — QuotaBook is a global equity management platform with a mission to create an ecosystem for private companies and their investors and employees. Leaving spreadsheets and manual works behind, every stakeholder can connect online and sync crucial data on equity such as cap table or employee stock options. It is the leading platform used by top startups and VCs in Asia, backed by Y Combinator.

This piece is written for information purposes only and is not intended as financial or legal advice. QuotaBook does not assume any reliability for dependence on the information provided above.